Long ago, I bought shares in Black Stone Minerals (BSM) on the advice of a family member. I’m not sure it was a good idea. When I bought, I had little idea of what BSM did or whether it was a fundamentally sound business. I didn’t lose money, but sinned in placing it somewhere I didn’t fully understand.

BSM’s share price has fluctuated since the investment. Now, it’s near what I originally paid. Redemption is in order. This post is the first in a two-part part series analyzing BSM. By the end, I’ll decide whether to liquidate my position, purchase more BSM shares, or do nothing. Below, I’ll give a description of what BSM does, how it makes money, and whether it has the trappings of a sound business. In the next post, I’ll build a discounted cash flow model to value BSM under different commodity price assumptions.

Please note I am not considering BSM from an ESG perspective.1 My only goal is to analyze a company I have a financial interest in.

I

BSM is a simple company. It makes all its money from mineral rights. When companies extract oil or natural gas from BSM’s land, it gets a cut of the price that barrel of oil or cubic meter of gas fetches on the market. Suppose I own an energy firm called Gusher & Co.. We want to drill for oil, but don’t have access to any oil-rich land ourselves. As a result, we call BSM and make a deal. Gusher & Co. pays a small amount upfront (a “lease bonus”) for access to a tract of their land.2 We then build a rig, pipelines, storage facilities, and all the accoutrements necessary for drilling oil on BSM’s land, at Gusher & Co’s expense. BSM, in exchange, gets a percentage of the revenue we receive from the oil. For instance, if we sell oil for $80 a barrel, BSM might take home $20 and we get the rest. If this sounds like a great deal for BSM, it’s because it is. In our example, BSM pays nothing to produce the oil but gets a cut of its sale. Gusher & Co. is fictional, but similar arrangements between BSM and real energy companies apply to thousands of rigs in the United States.

However, BSM’s real-life mineral rights come in many different flavors. All allow their holder a percentage of oil or gas revenue. They differ in the control the holder has over who drills the land or what they must contribute to drilling. For instance, BSM owns “Mineral Interests,” which, among other things, allows them to choose who drills their land. They have “nonparticipating royalty interests,” which gives them a cut of revenues, but no control over who drills the land. There are also “non-operated working interests,” which stills gives a cut of revenues but the holder must pay some of the cost of drilling. BSM has entered into “farmout” agreements with other parties for their working interests. In essence, this allows them to collect slightly reduced oil/gas royalties without paying the costs of drilling.3

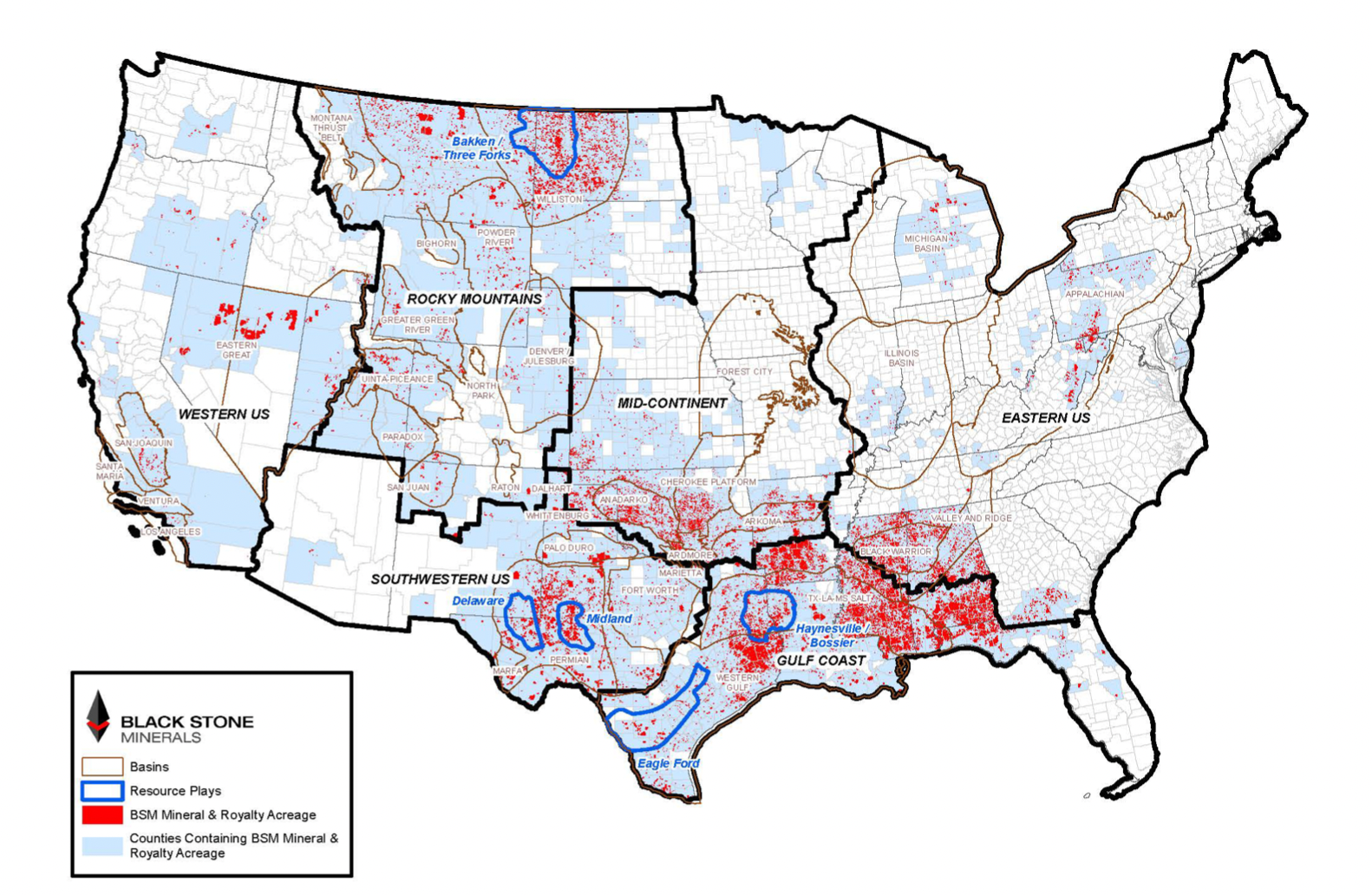

The scale of BSM’s mineral rights portfolio is brobdingnagian. It has rights in over 20 million acres in the United States which cover more than 7,000 wells. West Virginia, for context, is only 16 million acres. These rights cover every major oil and gas producing region in the country. Such regions are called “plays” in industry parlance. For instance, BSM owns rights in the Bakken/Three Forks play in the Dakotas, the Haynesville/Bossier play in East Texas, the Permian-Midland and Permian-Delaware plays in West Texas, and the Eagle Ford play in South Texas. These are some of the most productive plays in the country and cumulatively produce around half of US oil and gas.4 Note there’s an uneven split between oil and gas resources in BSM’s portfolio. For one, 70% of its proven reserves are gas. The rest is oil. Natural gas is also the company’s main source of revenue. In 2022, gas was 74% of the company’s production and 56% of its total revenues.

The following map gives a sense of how much coverage BSM has in the US. It was pulled from BSM’s 2022 10k filing.

I hope you, reader, have a fair sense of BSM’s business thus far. It acquires mineral rights, convinces energy companies to drill on its land, and then collects a percentage of the oil and gas revenue. Hopefully, it’s also clear BSM has an attractive business model. It gets paid when a leasee sells oil/gas, and in the vast majority of circumstances it pays nothing to extract the resources. Who doesn’t want to get a piece of the action while letting someone else take the headache of drilling wells and transporting oil/gas?

II

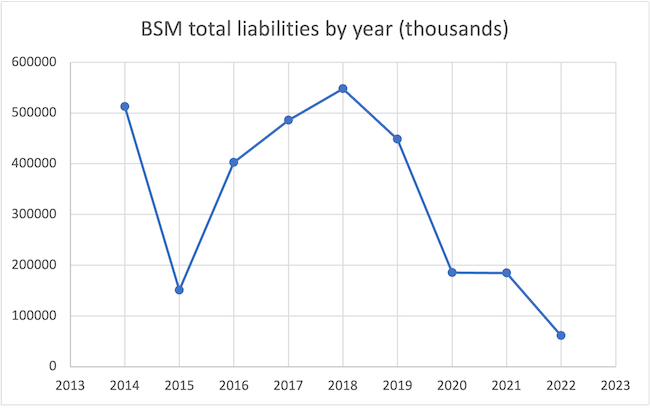

BSM’s financials, to my untrained eye, are nearly pristine. One might think acquiring millions of acres of prime mineral rights would leave a company crushed with debt. BSM may have been well-leveraged in the past, but they’ve almost erased their burden.

Source: own data compiled from 10ks.

As of Q2 2023, it has $33 million of debt on $1.2 billion of assets. BSM’s accounts receivable alone is a healthy $94 million.

Other indicators bely a sound business. General and Administrative expenses are the firm’s largest, besides large depreciations on their mineral rights portfolio. With little debt, and a business model that relies on collecting royalties from other peoples’ drilling activities, it’s difficult for BSM to mess up. Since BSM IPO’d in 2014, it has only had negative earnings once, which is an achievement in the volatile oil and gas industry.

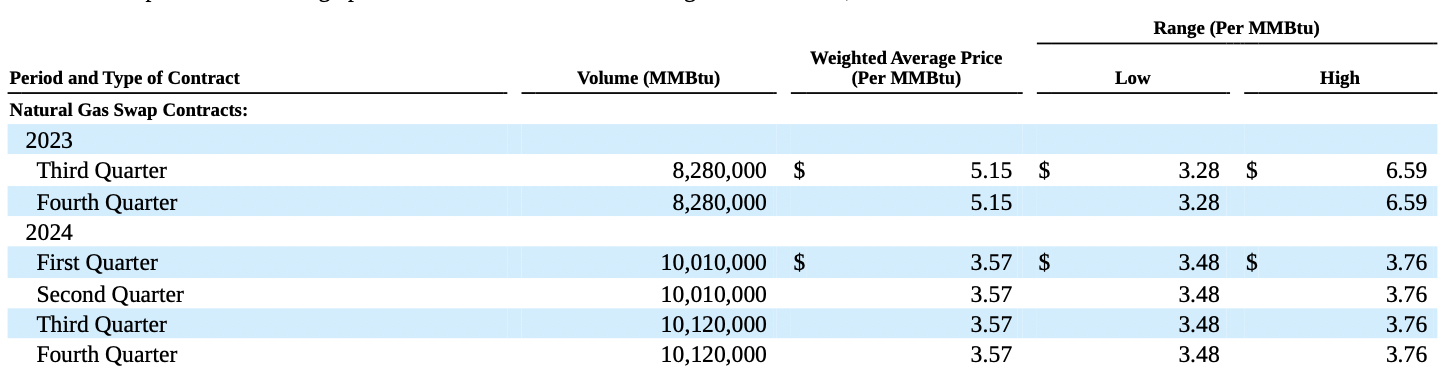

BSM owes its stability partly to derivatives. They purchase millions of dollars of contracts annually to protect against swings in oil and natural gas prices. In effect, this guarantees a portion of future revenue. According to BSM’s 2022 10K, up to 50% of future production volume can be hedged up to four years out, per the agreement with their credit facility. Management uses these privileges liberally. The following table was included in BSM’s 2023 Q2 report. It gives quantity of natural gas production hedged and average price received for the rest of 2023 and all of 2024.

For context, BSM produced 14,000,000 Btus of natural gas in Q2 2023. If we assume production stays roughly the same through the following two quarters, it has hedged roughly 57% of natural gas production for the rest of the year at an average price of $5.15. They’re even more conservative for 2024. They’ve guaranteed ~$142 million of natural gas revenue for the year, or ~33% of historical yearly revenue figures, effectively locking in prices for ~.71 of production assuming 14,000,000 Btus a quarter.

BSM’s hedging strategy has helped, and hurt, the company. In some years, derivatives have contributed ~10% of total revenue, allowing BSM to post decent numbers when oil and gas prices are depressed. If prices rise, though, BSM doesn’t benefit. In 2021 and 2022 when energy prices spiked post-COVID and with the war in Ukraine, losses on derivative erased ~30% and ~15% of BSM’s revenue, respectively. From an investor point of view, BSM’s hedging habit means it’s an inappropriate vehicle to bet on energy price fluctuations. If you have views on the price of oil one year ahead, there are contracts for that. BSM, by contrast, will only benefit with a secular rise in oil and natural gas prices.

III

BSM, to my eyes, is a good business. It’s operations are simple enough even I can understand them, expenses are few, and debt is low. Management, to my understanding, is also committed to running a conversative operation and maintaining a high dividend. The company has weaknesses, however.

The largest is its exposure to volatile prices. BSM’s fortunes are directly tied to oil and gas rates. If prices decline, revenue declines, and there’s nothing BSM can do about it. It has no control over prices or its amount of production. Remember, third parties run the wells drilled on BSM’s land. If, for whatever reason, BSM wanted to change production levels, it couldn’t.

I have two responses to concern about prices. First, as described earlier, BSM hedges against fluctuations in energy prices. A large proportion of its oil and gas production will, in effect, receive a guaranteed price a year out. The company is well-positioned to endure short term turbulence. In the long term, one may argue, it’s still exposed to energy prices, but that touches the second point. Exposure to long term energy prices is why investing in BSM is attractive. It’s an energy company. Anyone who seriously considers it should have a view on where prices are going. Investing in BSM without such a view strikes me as silly.

I do not have a view on prices, yet. At the moment, I can only say BSM is a good company, but an uncertain investment opportunity. It’s easy to overpay for good companies. In the next post, I’ll ballpark BSM’s value by forecasting future cash flows under a variety of oil and natural gas price scenarios.

-

I assure you that analysis would be far shorter. ↩︎

-

I talk about “BSM’s land” for ease of exposition. The legal reality is messier. BSM may own the mineral rights to that land, but not necessarily the land itself, or ‘surface rights.’ However, in the United States, mineral rights holders are entitled to whatever surface access needed to exploit their resources. Source, source. ↩︎

-

For the legally curious, I recommend Pheasant Energy’s page on mineral rights. ↩︎

-

These are just production figures from the plays. BSM does not have mineral rights in half of US oil and gas production. ↩︎